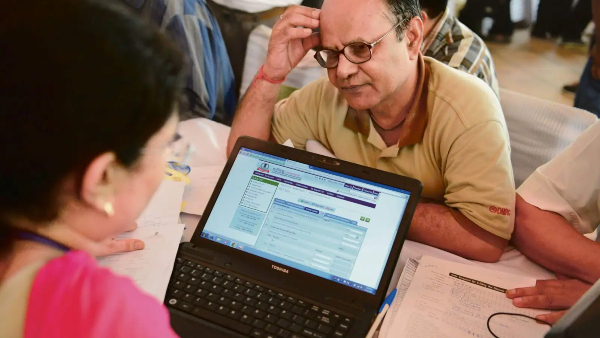

As the last date for fling income tax return (ITR) 31 July is nearing, many taxpayers are yet to file their IT returns. But for those who have already filed their ITR, the income tax department has started sending refunds back to the accounts of those who are eligible for refunds.

If a taxpayer fails to file income tax return by 31 July, a penalty of ₹1,000 will be levied if income is within ₹5 lakh and a penalty of ₹5,000 if income exceeds ₹5 lakh.

Once an ITR has been filed, refunds are processed within 20-45 days by the income tax department. A taxpayer needs to check from time to time the status of IT refund from the tax department.

Steps to check online status of tax refund

1 – Visit the Income Tax e-filing portal

2 – Login with user ID, password, date of birth/date of incorporation and captcha.

3 – Go to My Account

4 – Click on Refund/Demand status

5 – Your details like Assessment year, status, Reason (for refund failure if any), Mode of Payment is displayed.

On 19 July, the income tax department said over 3 crore ITRs for income earned in 2022-23 fiscal have been filed so far, out of which 91% have been verified electronically.

“Out of the 3.06 crore ITRs filed till 18th July, 2023, 2.81 crore ITRs have been e-verified i.e. more than 91 per cent ITRs filed have been e-verified! Out of the e-verified ITRs, more than 1.50 crore ITRs have already been processed,” the I-T department tweeted.

The 3 crore-milestone in income tax return (ITR) filing has been reached 7 days earlier this year.

On 18 July, the income tax department said Non-Resident Indians (NRIs) and foreign citizens whose permanent account numbers have become inoperative due to non-linking with Aadhaar should submit proof of their residential status to the jurisdictional assessing officer for operationalising the PAN.

The department said concerns have been raised by certain NRIs/Overseas Citizens of India (OCIs) regarding their PANs (Permanent Account Numbers) becoming inoperative.

In a tweet, the department said it has mapped the residential status of NRIs in case they have filed ITR in any of the last three assessment years (AYs) or have intimated their residential status to the Jurisdictional Assessing Officer (JAO).

The PANs, according to the department, have become inoperative in cases where NRIs have not updated their residential status or have not filed returns in the last three AYs. “The NRIs whose PANs are inoperative are requested to intimate their residential status to their respective JAO along with supporting documents with a request to update their residential status in the PAN database,” it tweeted.

Source By: livemint